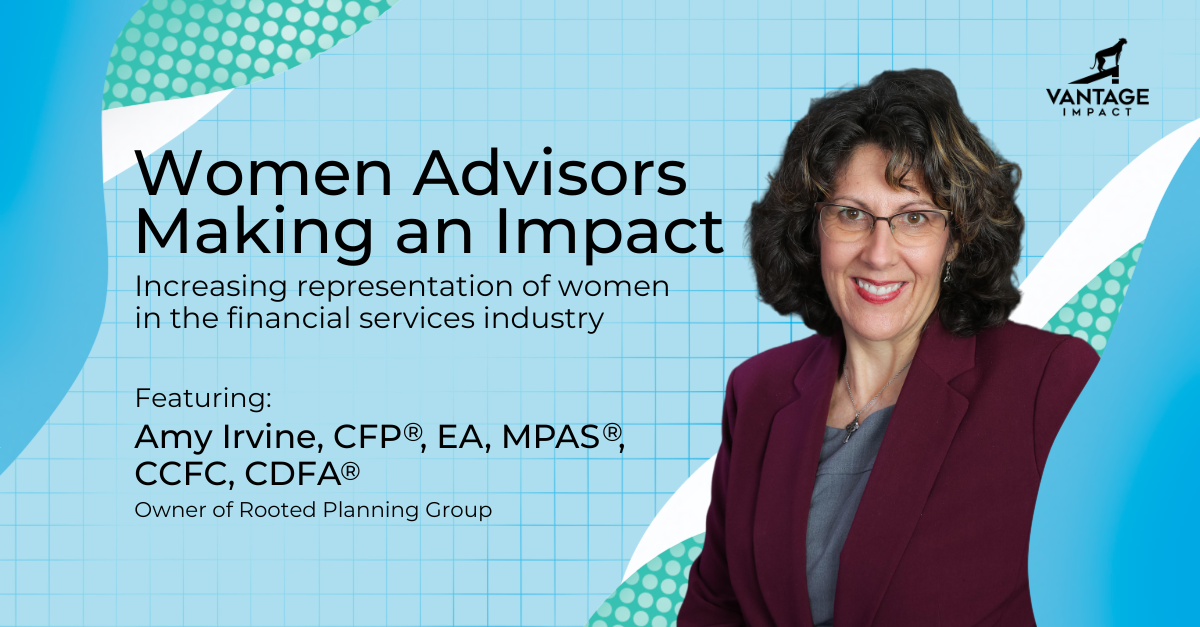

Amy Irvine

Leading By Example

How Amy Irvine recruits and supports fellow women financial planners at her 100% woman-owned firm

For Amy Irvine, starting an independent RIA—consisting of women advisors only—was the culmination of her diverse work experience and knowledge, gathered through various roles in financial services over two decades.

Irvine put that knowledge into action when she started her own financial advising firm, Rooted Planning Group, in 2015. Her first degree was in accounting, but she realized very quickly that was not the career field for her. She discovered the world of financial services in January of 1994, working in an operational role for a trust department, which then morphed into working directly with 401(k) plans and plan participants. She went back to school for a bachelor’s degree in financial planning, Irvine’s former roles include Chief Compliance Officer and Financial Planning Director at Pinnacle Financial Wealth Management, LLC, and the Director of Financial Planning and Chief Compliance Officer at Burns Matteson Capital Management. Along the way, she also earned a master’s degree in personal financial planning from the College of Financial Planning and a CERTIFIED FINANCIAL PLANNER™ professional designation, along with the Enrolled Agent, Chartered College Financial Consultant, and Certified Financial Divorce Analyst.

She also spent time as a financial coach at an RIA, which she called “the final piece of the puzzle.” Every step of her diverse career got her one step closer to being fully prepared to start her own business.

Even with all the expertise Irvine brought to the table, the transition to owning her own firm was still challenging. She was nervous about the inherent risk of self-employment; for her entire career she had shown up to work and received her paycheck, health insurance, and retirement benefits from a company, and now that responsibility was on her. She planned ahead, setting aside savings, but still calls launching the firm “the most emotionally draining, and scariest, decision of my life.” When she thinks back, a friend helped her put things in perspective and finally go for it.

“She asked me, ‘What’s the worst that could happen?’ And I thought, well, if this business doesn’t succeed, I’m going to be embarrassed, and I’m going to have to get a job. And she said, ‘That’s the worst?!’” Irvine recalls with a chuckle.

In fact, the business grew more quickly than even she expected, which is why she began adding advisors to her team. She started by hiring two women who are still with the firm today.

She didn’t set out to create an all-woman firm. But when it morphed organically to a stellar group of employees who happened to be women, she became more intentional about the choice.

“We realized that there was something about the dynamics of all of us women and different ages working together,” Irvine says. “I took stock of the fact that there were unspoken things we didn’t have to say to each other — we just understood as women working together and trying to raise families, or as I jokingly say, raise parents — it was just something that really clicked. And that’s when it became intentional. It is intentionally an all-women firm that has really strong guidelines to make sure that not only will women come into this, but they’ll stay in it.”

Today, Rooted Planning Group is a 100% women-owned firm that offers fee-only financial planning and hourly advising services, and they don’t have a minimum asset requirement. Because for Irvine and her team of five advisors and three support staff, it is about helping their clients build the life they want and achieve their goals, whatever their financial situation.

One of the things that motivated Irvine to start her own business was she craved the flexibility of working for herself and the possibility of working remotely, since she and her husband wanted to split time between New York and Florida. She also wanted the freedom to focus on advising women clients.

Irvine determined she wanted to work with Gen X women and their families, noticing that they seemed to be the forgotten generation between Baby Boomers and Gen Y. Many of her friends were looking for financial advice as they encountered job changes, new houses, relocations, and children heading off to college.

Irvine set out to help those families manage their competing priorities and meet their financial goals. But many of them had diligently saved into retirement accounts that they couldn’t yet access, or were told by firms that they didn’t have enough assets to manage.

“They couldn't find the help that they were looking for when it came to financial planning,” Irvine says. “So as soon as I launched my firm, it was just the perfect timing. In some respects, I wish I'd done it sooner.”

Alongside her staff of women at Rooted Planning Group, Irvine takes an educational approach to financial planning. Since financial literacy is not taught in most school curriculums, Irvine wants to teach and empower her clients.

“For our clientele, one of the things that they’re looking for is somebody to be a partner. They may want to hire us because they don’t have time to do this sort of thing, but [want] to understand what we’re doing,” she says.

In addition to educating her clients, Irvine also strives to understand each client’s approach to money, to best guide them in their financial decision making. She tailors her recommendations individually, laying out multiple options so that they can make an informed decision. Many of her clients, for example, come to her for guidance about financing their children’s education. She has found some are comfortable taking out loans, while others don’t want to be in debt or pay interest.

“If you have five people sitting in a room with similar situations, the answer may be different for all five people. Understanding each client’s money psychology is critical,” she says.

Irvine’s customized, flexible approach to managing her clients also works with her employees. Rooted Planning Group is located in Corning, New York, but they had embraced remote work long before the COVID-19 pandemic made it a necessity and have employees across the U.S. And, the firm has flexible schedules to accommodate home and family responsibilities.

Outside of Rooted Planning group, Irvine is active with the National Association of Personal Financial Advisors, and combines her interests in finance and wine as the host of a podcast called Wine and Dime and author of the book, "Uncork Your Finances.”

To any other advisors considering starting their own firm, she warns not to let fear of change or embarrassment about potential failure hold you back. “Every single day I was giving advice about how they can love their life, and here I’m just playing along. Great financial planner, not to do as you say,” Irvine says with a smile, recalling the years before she started her firm.

“So it got to the point where it was more important for me to start moving forward with the life I wanted to live, just like I tell my clients. I needed to be an example for them.”